At EQT, we constantly seek ways to enhance the strategic value of our investments and improve the decision-making process. CARTO has been a game-changer for EQT, their cloud-native platform, seamless data integration, Builder for visualization and Analytics Toolbox make it much easier for us to assess investment opportunities and provide strategic advice to our portfolio companies.

Sonja Horn

,

Data Scientist at EQT

At EQT, we constantly seek ways to enhance the strategic value of our investments and improve the decision-making process. CARTO has been a game-changer for EQT, their cloud-native platform, seamless data integration, Builder for visualization and Analytics Toolbox make it much easier for us to assess investment opportunities and provide strategic advice to our portfolio companies.

Sonja Horn

,

Data Scientist at EQT

The Client

EQT

EQT is a purpose-driven global investment organization with close to three decades of consistent investment performance across multiple geographies, sectors, and strategies. The organization is managing 237 billion USD in assets across diverse sectors, and 280 portfolio companies. In 2022, EQT ranked as the third largest private equity firm worldwide based on funds raised.

The Challenge

Decoding Location-Based Insights for Portfolio Companies

EQT faced a common challenge in its quest for maximizing value and strategic decision-making. Their portfolio companies lacked the data-driven, location-based insights necessary to among other things optimize marketing strategies such as ROI and drive mergers and acquisitions (M&A). Moreover, EQT needed to streamline their decision-making process, ensuring faster and more effective solutions for their investments.

Results

Geospatial Analysis for EQT Investments and Strategic Advice

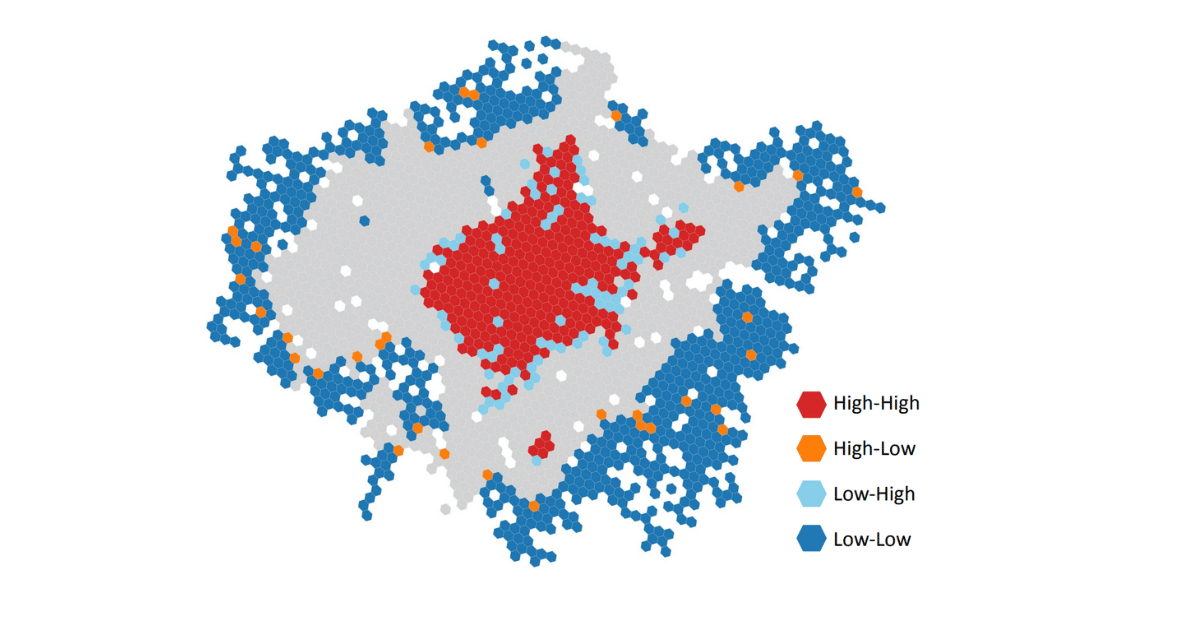

With CARTO, EQT gained a comprehensive understanding of the geographical components that affect their portfolio companies' operations, especially in terms of proximity to operating locations. This not only improved their marketing strategies but also streamlined M&A activities.

EQT’s portfolio companies saw a notable improvement in their marketing ROI as they transitioned from a wide net approach to a more precise strategy. The spatial composite score developed using CARTO geospatial technology led to better-informed and more effective marketing decisions for portfolio companies, further enhancing their profitability.

Additionally, by implementing location intelligence through CARTO, EQT’s portfolio companies made more data-driven decisions in their M&A activities, leading to better target identification and investment outcomes.

Why CARTO?

Custom Solutions with CARTO

CARTO proved to be the ideal partner for EQT and its portfolio companies, thanks to several key factors:

Easy to use, collaborative software

CARTO's cloud-native platform allowed EQT to achieve proof of concept and value within weeks, an incredible advantage in the fast-paced investment world.

Big Data Performance

CARTO can efficiently analyze and visualize large geospatial datasets, without running into performance bottlenecks, providing highly performant visualizations for datasets of any size and in a very cost-effective way. CARTO's geospatial features empowered EQT and their portfolio companies to make data-driven decisions, increasing the efficiency and impact of marketing strategies and M&A activities.

Custom Solutions

CARTO's versatile platform offered both end-to-end solutions and niche technologies, accommodating various project complexities and delivering tailored solutions for EQT's portfolio companies.